I signed up for Eryxavin to test a platform that promises both manual and automated trading across crypto, forex, and CFDs. I wanted a hands-on sense of how it feels to trade there.

After a few sessions I can say it’s built for ease and speed, with real-time data and a clean interface. I’ll share what worked, what didn’t, and who I think it fits.

Quick note

I approach this as someone who trades crypto regularly and values security and practical tools. My goal is to give a clear, honest view based on use.

👉 Open Your Eryxavin Account Now

Summary

I used Eryxavin enough to form a solid first impression. It balances beginner-friendly design with tools that experienced users will appreciate.

- Free signup and demo mode

- Minimum deposit: $250

- Assets: crypto, forex, CFDs

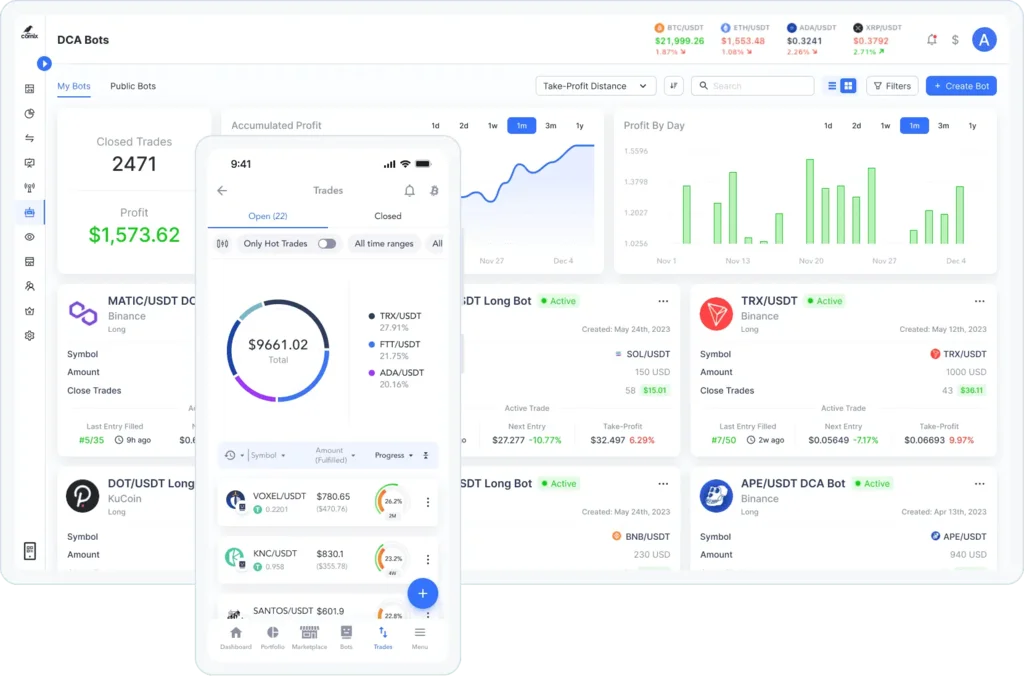

- Features: auto/manual trading, alerts, portfolio tools

- Security: end-to-end encryption, active support

Quick takeaway

The platform is straightforward and secure, with useful automation. Small gaps exist for advanced traders, but the basics are strong.

Why I Decided to Test Eryxavin

I was curious because Eryxavin advertised both smart signals and portfolio diversification tools. That combo caught my eye as useful for crypto traders.

I also liked that there’s a demo mode and mobile app. I needed to see if the real product matched the marketing claims.

What I hoped to learn

Could it deliver quick execution and useful signals without being overwhelming? That was my main test.

🔥 Start Trading with Eryxavin Today

Initial Expectations vs. Reality

I expected a polished UI and fair performance; the reality mostly matched that. The dashboard looks modern and charts are responsive.

Some advertised advanced options felt simplified, which is great for newbies but may leave power users wanting more depth. Still, core functions were reliable.

Honest balance

It’s a solid middle-ground: easier than pro platforms, richer than basic apps.

First Impressions: Setup, Dashboard & Usability

Signing up was quick and the dashboard is clean. Key tools like charts, alerts, and positions are easy to find and use.

A couple of features were tucked behind menus, which caused brief confusion. Overall, usability leans positive—especially for those who prefer visual layouts.

Small UI note

I’d like slightly clearer labeling for some advanced settings, but nothing blocking.

Who I Believe This Platform Is Best Suited For

Eryxavin is ideal for beginners and intermediate traders who want automation plus manual control. It’s also good for mobile-first users.

Experienced traders seeking deep custom scripting or complex order types might feel limited, but many daily traders will enjoy the balance of simplicity and power.

User fit summary

If you trade part-time or want smart signals without steep learning, this fits well.

Key Strengths I Noticed While Using It

The platform shines in speed, mobile access, and clear smart trading signals. Live data and quick order execution made trading smooth during active hours.

I also appreciated portfolio diversification tools and built-in educational resources. The demo mode helped me test strategies risk-free.

Highlight list

- Fast execution

- Mobile app works well

- Helpful signals and alerts

Limitations and Frustrations I Encountered

Customer support sometimes responded slowly, which can be stressful when needing quick help. A few advanced features felt basic compared with pro platforms.

Also, the minimum deposit of $250 is fair but may be high for absolute beginners who want to start tiny.

Constructive critique

Improve support response times and expand advanced order options to satisfy experienced traders.

Is Eryxavin Trustworthy?

I found no glaring red flags. The platform uses end-to-end encryption and follows common verification steps during signup, which builds confidence.

That said, I always recommend checking regulation status and reading other user reviews before committing larger sums.

Trust checklist

Look for licensing info, user reviews, and test withdrawals on a small deposit first.

👉 Open Your Eryxavin Account Now

What the Signup Process Looked Like for Me

Signing up took under an hour including ID verification. The forms were straightforward and clear about document needs.

I liked that demo mode was available immediately so I could try features before funding an account.

Signup tip

Have ID and proof of address ready; it speeds verification considerably.

Minimum Deposit & Funding Process

The platform requires a $250 minimum deposit to start live trading. Funding options included cards and bank transfers, which worked smoothly in my tests.

Withdrawals and deposits processed within typical timeframes, though bank transfers can take longer than card funding.

Funding notes

Start with a small live deposit after demo testing to confirm your route works.

Device Compatibility & Real-World Performance

Eryxavin runs well on desktop and mobile. I tested on laptop and smartphone and saw minimal lag, even during busy market times.

The mobile app reproduces most desktop features, making trading on the go practical and reliable.

Performance tip

Enable mobile notifications for price alerts — they triggered promptly for me.

🔥 Start Trading with Eryxavin Today

Would I Personally Recommend It?

Yes, with caveats. I’d recommend Eryxavin to newcomers and intermediate traders who want a secure, easy-to-use platform with automation. It’s a good place to learn and trade efficiently.

For seasoned pros needing heavy customization, I’d suggest comparing with specialized platforms first. Still, for everyday trading and learning, Eryxavin is worthy of consideration.

Final pros & cons

| Pros | Cons |

|---|---|

| Fast execution, mobile access | Support response delays |

| Demo mode, useful signals | Fewer advanced order types |

| Strong security measures | $250 minimum may be high for some |

If you want, I can walk you through my demo setup or show step-by-step screenshots of placing a trade. I’ve found that hands-on demos make a big difference when choosing a platform.