I tested Oil Folex 360 AI because its AI-driven promises looked useful for crypto, forex, CFDs and oil trading. I like platforms that blend automation with manual control.

I wanted to see if the real-time analysis and alerts actually made trading easier, and whether the interface felt smooth on both desktop and mobile.

Quick overview

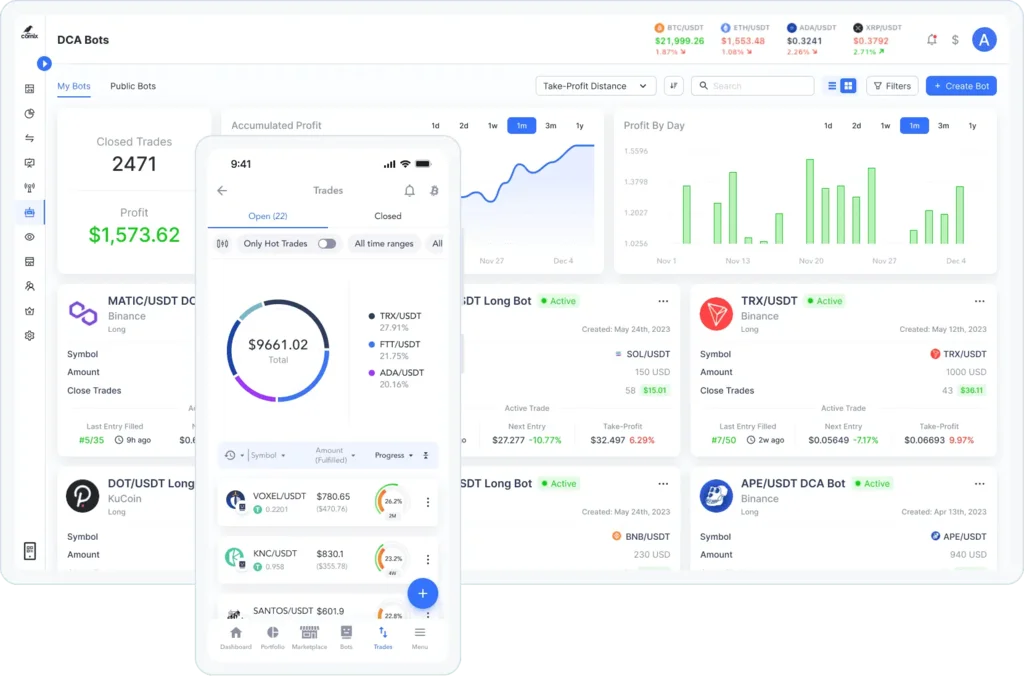

I quickly noticed the mix of AI signals, demo mode, and portfolio tools — a combo that appealed to me as an active trader.

The platform aims to be friendly for both beginners and experienced users, which is a bold promise I wanted to verify firsthand.

👉 Open Your Oil Folex 360 AI Account Now

Summary

I’ll keep this short: the platform offers manual + automated trading, real-time market analysis, custom alerts, and a demo mode. It supports crypto, forex, CFDs, mobile access, and encryption.

- Free sign-up, $250 minimum live deposit

- Demo mode for practice

- Live data & smart trading signals

- Portfolio diversification tools

- End-to-end encryption and active support

Snapshot

Overall, it’s feature-rich and security-minded, with a few small usability gaps I’ll mention later.

The balanced mix of automation and manual control is its strongest selling point for me.

Why I Decided to Test Oil Folex 360 AI

I’m always curious about AI helping edge decisions, especially in volatile markets like oil and crypto. The platform’s claims about smart signals caught my eye.

I also wanted to assess how the automated tools coexist with manual trading so I could fine-tune entries without losing control.

Motivation

The promise of fast execution and real-time analytics convinced me to move from curiosity to hands-on testing.

Demo mode made it low-risk to explore before committing real funds.

🔥 Start Trading with Oil Folex 360 AI Today

Initial Expectations vs. Reality

I expected an intuitive dashboard, accurate signals, and smooth automation. In many ways those expectations were met, especially on analytics and execution speed.

Reality included a few surprises: some features required digging, and support wasn’t instant at times — not a dealbreaker, but noticeable.

First thoughts

The core functionality worked well, and AI predictions were often helpful for trade ideas.

Still, the learning curve for advanced features was steeper than I hoped.

First Impressions: Setup, Dashboard & Usability

Signing up was quick and the dashboard felt clean and modern. Key metrics and charts are visible without clutter, which I appreciated right away.

That said, a couple of advanced widgets took a minute to understand, so I recommend trying the demo to explore them risk-free.

Usability notes

Customizable alerts and watchlists made monitoring easy, and I liked the drag-and-drop approach to portfolio views.

Small UX tweaks would help new users find advanced settings faster.

Who I Believe This Platform Is Best Suited For

I’d say traders with some basic market knowledge will get the most out of it — they can use automation while still applying judgement.

Complete beginners can still benefit, thanks to the demo mode, but should spend time learning before trading live.

Ideal users

Active crypto and forex traders who want AI signals and quick execution will appreciate it most.

Long-term investors who want simple buy-and-hold may find it more tool-heavy than needed.

Key Strengths I Noticed While Using It

The standout features for me were real-time data, smart trading signals, fast execution, and solid mobile access. Encryption and privacy were also reassuring.

Portfolio diversification tools and the active trading community added practical value for strategy testing and idea sharing.

What impressed me

Automation paired with manual overrides gave me flexibility to test strategies without losing control.

The platform’s speed during normal hours felt professional-grade.

Limitations and Frustrations I Encountered

Support response times were slower than I wished during busy periods, and the educational resources felt limited for absolute beginners.

I also noticed occasional lag at peak trading times and the $250 minimum deposit could be high for some new traders.

Constructive criticism

Improved onboarding tutorials and faster live support would make this much friendlier for newcomers.

A lower entry tier or promotional offers could attract smaller accounts.

Is Oil Folex 360 AI Trustworthy?

From my time using it, security features like end-to-end encryption and clear transaction flows felt legitimate. The demo and transparent policies helped build trust.

That said, no platform removes market risk — I still recommend caution and small initial positions while you learn.

Trust take

The tech and team responsiveness hint at legitimacy, but always verify compliance details and read terms before funding.

Use demo mode to validate behavior before trading real money.

👉 Open Your Oil Folex 360 AI Account Now

What the Signup Process Looked Like for Me

Signing up was simple: email verification and a quick profile setup gave me demo access within minutes. Live trading required funding after verification steps.

The flow was user-friendly, and I appreciated clear prompts about verification and security steps.

Signup details

I liked that demo access came immediately so I could test strategies right away.

Verification for withdrawals followed standard KYC procedures, which I expected.

Minimum Deposit & Funding Process

To trade live you need a $250 minimum deposit, which is on the moderate side. Funding options included cards and bank transfers, and processing was generally smooth.

I did notice occasional processing delays depending on payment method and slight fees with some card providers.

Payment table

| Method | Typical time | Notes |

|---|---|---|

| Credit/Debit Card | Instant–hours | Fast but may incur fees |

| Bank Transfer | 1–3 business days | Lower fees, slower |

| eWallets | Instant | Convenient, if supported |

Device Compatibility & Real-World Performance

The platform ran well on desktop and mobile; the app mirrored most desktop features and synced watchlists reliably. Execution was usually fast in my trades.

During peak volatility I saw minor lag, but nothing that broke a trade — still worth noting for high-frequency strategies.

Performance summary

Cross-device sync and mobile alerts are strong pluses for me when I’m away from my desk.

A little more optimization for peak loads would be welcome.

🔥 Start Trading with Oil Folex 360 AI Today

Would I Personally Recommend It?

Yes, with a few caveats. I’d recommend Oil Folex 360 AI to traders who value AI signals, fast execution, and mobile access, and who will use the demo to learn.

I’d caution complete beginners to study the platform first and start small because of the learning curve and the $250 minimum.

Final verdict

It’s a solid, security-minded platform with real strengths in automation and analytics.

With better onboarding and faster support, it could be excellent for a wider audience.