I jumped into this trading platform curious and cautious. I wanted a tool that made crypto, forex, and CFD trading accessible without hiding risks.

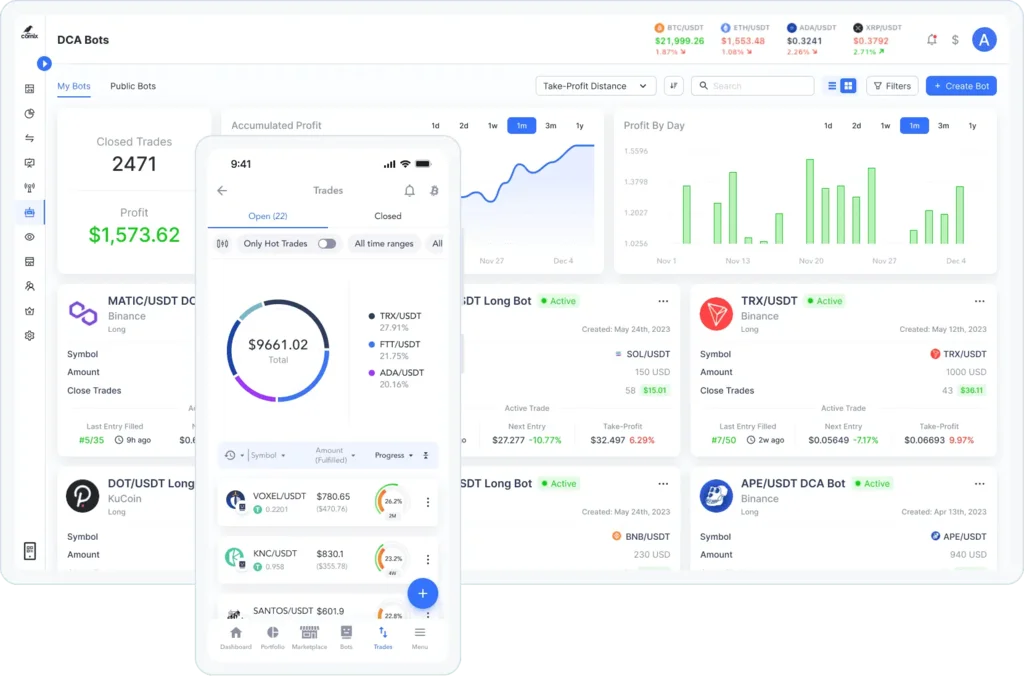

My first sessions showed a clean interface, real-time data, and both manual and automated tools that felt approachable for new users.

Quick context

I use trading tools daily and value simplicity. This platform promises automated trading plus manual controls for flexibility.

As a user I look for security, clear fees, and reliable execution before trusting a system with real funds.

👉 Open Your Bitcoin Era Account Now

Summary

I tested the platform to see how friendly and effective it is. Below are the key facts I found, presented as quick bullet points inside this summary.

- Offers manual and automated trading for crypto, forex, and CFDs

- Free signup, minimum deposit $250, demo mode available

- Features real-time analysis, customizable alerts, and mobile access

- Security includes end-to-end encryption and active support

- Includes portfolio diversification tools and a trading community

Snapshot takeaway

Overall, it’s easy to start and friendly for beginners, with tools that scale for more advanced users.

I like the balance of automation and manual control, though users should know markets are risky.

Why I Decided to Test Bitcoin Era

I wanted to see if the platform lived up to its claims of fast setup and useful automation. My goal was practical: test usability and real results.

I was also curious about the demo mode and how well signals tracked live markets in real conditions.

Motivation in practice

I sought a platform that saves time but still lets me learn trading mechanics. The promise of smart signals and quick execution attracted me.

I also wanted to assess customer support responsiveness and data protection in real usage.

🔥 Start Trading with Bitcoin Era Today

Initial Expectations vs. Reality

I expected a simple onboarding and mostly hands-off profits if I used automation. In reality, setup was simple, but results required tuning.

Automation helped but wasn’t a magic profit button; market swings meant I still monitored positions regularly.

What surprised me

I was pleased by fast execution and clear alerts. The automated strategy templates worked as a strong starting point.

However, success depended on settings, market conditions, and occasional manual intervention.

First Impressions: Setup, Dashboard & Usability

Signing up was quick and the dashboard felt uncluttered. I appreciated clear charts, order entry, and quick access to the demo account.

The layout made switching between manual and automated modes intuitive, which is great for mixed strategies.

Usability notes

Customization options were straightforward; I set alerts and adjusted risk easily. Mobile and desktop behaved consistently.

Small gripe: a couple of advanced tooltips could be more detailed for intermediate traders.

Who I Believe This Platform Is Best Suited For

I’d recommend it to beginners who want guided automation and to busy users who need hands-off options with manual overrides.

Intermediate traders will also find value, though very advanced traders might want deeper analytics elsewhere.

Ideal user profile

If you want to start with a demo, gradually fund with the $250 minimum, and use smart signals, this fits well.

If you need ultra-advanced charting or bespoke algo coding, consider pairing it with other tools.

Key Strengths I Noticed While Using It

The platform shines in speed, mobile accessibility, and straightforward automated trading. Live signals and portfolio tools help manage risk.

Security and community support give confidence, and the demo mode is a great learning space.

Feature highlights

- Fast execution and responsive mobile app

- Live data and smart trading signals

- Portfolio diversification tools and demo mode

I liked how setup-to-trade time was minimal and how community tips helped refine settings.

Limitations and Frustrations I Encountered

Customer support was active but not always instant, which can be annoying during trades. Also, automated strategies sometimes needed frequent tweaking.

Fees and spread details could be clearer upfront for some instruments.

Constructive points

- Support response times varied during peak hours.

- Automation can produce losses in volatile markets.

- Some fee disclosures could be more transparent.

These are typical for many platforms and don’t outweigh the positives for casual users.

Is Bitcoin Era Trustworthy?

The platform uses end-to-end encryption, secure payments, and links to regulated brokers, which boosts trust. Mixed user reviews exist, so I stayed cautious.

I treated the service as a useful tool rather than a guaranteed income source, keeping risk controls in place.

My trust checklist

I verified encryption, read broker terms, and tested withdrawals via demo-to-live transitions.

I recommend starting small and confirming support responsiveness before larger deposits.

👉 Open Your Bitcoin Era Account Now

What the Signup Process Looked Like for Me

Registration was a short form and email verification. I then completed identity checks tied to the broker partner before funding.

The flow from signup to trading took minutes once documents were uploaded and verified.

Practical signup tips

Have ID and proof of address ready to speed verification. Use demo mode first to confirm you like the UI and signals.

Expect a quick broker handoff after initial registration.

Minimum Deposit & Funding Process

The minimum live deposit was $250, which is accessible for many new traders. Multiple payment methods simplified funding and I saw funds reflected quickly.

Below is a tiny table summarizing funding basics.

| Item | Details |

|---|---|

| Min deposit | $250 |

| Methods | Card, bank transfer (varies by broker) |

| Demo | Free, unlimited practice mode |

Funding notes

Double-check any broker-specific fees or withdrawal times. The platform guides you through the broker funding screen.

I recommend starting with the demo and then a modest first deposit to test the withdrawal process.

Device Compatibility & Real-World Performance

I used desktop and mobile; both were stable. Mobile trading executed orders fast, and live alerts arrived on time.

Real-world automated performance varied with market volatility—some days were profitable, others required manual changes.

Performance summary

The platform is well-optimized for both platforms and keeps data in sync. Expect standard internet-related delays in extreme conditions.

For critical trades, I monitored positions from desktop when possible.

🔥 Start Trading with Bitcoin Era Today

Would I Personally Recommend It?

Yes, with caveats. I’d recommend it to beginners and busy traders who want simple automation and a helpful demo mode. It’s a solid learning and trading platform.

However, always treat it as a tool, not a guarantee. Start small, use demo mode, and learn basic risk management.

Final advice

- Begin with the demo and learn signals.

- Keep initial real deposits modest (start at $250).

- Use stops, diversify, and monitor automation regularly.

I’ve found it useful, but smart risk habits remain essential for success.