I’ve been trading crypto for years, and I like testing new platforms to see what really helps traders. Bitcoin Sprint caught my eye because it mixes manual and automated tools in one place.

I wanted a quick, honest take from someone who uses these tools daily. This review is my hands-on view, with clear notes on what works well and what could improve.

Quick first thoughts

The interface felt clean and focused, good for both learning and fast trading. Some advanced features are lighter than on pro platforms, but the basics are solid and secure.

I appreciated the focus on usability and security, which matters most when you’re moving real funds.

👉 Open Your Bitcoin Sprint Account Now

Summary

- Free signup and demo mode

- $250 minimum deposit to start trading

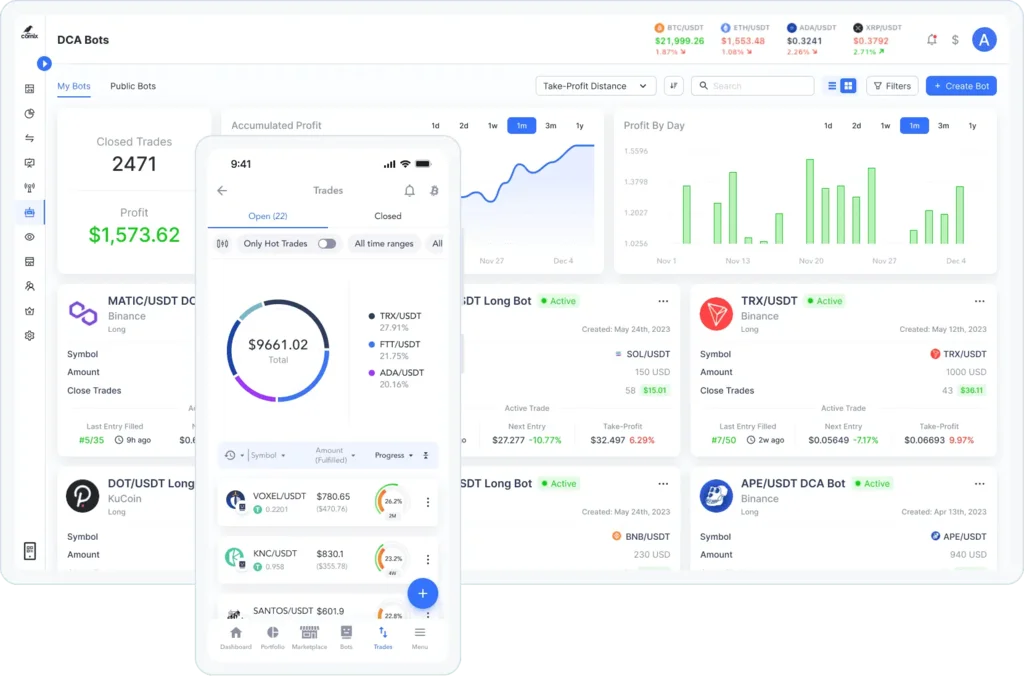

- Manual and automated trading for crypto, forex, CFDs

- Live data, smart signals, mobile access, portfolio tools

- End-to-end encryption, active support, trading community

Overall, it’s a feature-rich platform for beginners and casual users, with a few minor limits for power traders.

Quick fact sheet note

I liked that the demo lets you practice without risk, and that the platform pushes fast execution and real-time updates. Withdrawals can be slower at times, but the security measures are reassuring.

Why I Decided to Test Bitcoin Sprint

I wanted to see if the automation really saves time and if the platform is friendly for newcomers. Promises of easy setup and smart signals made me curious.

As someone who values both control and convenience, I tested both manual trades and the automated tools across a few market sessions to compare results and workflow.

What I aimed to learn

My goal was to check setup speed, signal accuracy, execution times, and how well the demo and support work when issues pop up.

I also tested mobile performance, since I trade on the go and need quick, reliable access.

🔥 Start Trading with Bitcoin Sprint Today

Initial Expectations vs. Reality

I expected a simple, reliable interface and functional automation. In reality, the UI was clean and automation worked, but signal tuning needed oversight.

The platform met expectations on usability and security, though I found fewer advanced analytics than some pro traders might want.

Balance of pros and cons

The setup felt beginner-friendly and fast, yet occasional lags during peak times reminded me to keep manual checks in place with automation.

Still, for the typical user seeking convenience, it delivered more strengths than weaknesses.

First Impressions: Setup, Dashboard & Usability

Signing up was quick and the dashboard is streamlined; I found key stats and open positions easily. The demo mode is handy for practice.

Some tooltips and mini-guides would help absolute beginners, but overall the workflow is logical and fast to learn.

Day-to-day experience

Placing trades felt responsive, and alerts helped me react to moves. A clearer explanation of some indicators would speed up the learning curve.

I liked the portfolio overview and how balances and P&L are displayed at a glance.

Who I Believe This Platform Is Best Suited For

I think it’s perfect for beginners and intermediate traders who want automation without complexity. The demo and simple UI lower the barrier to entry.

Experienced traders who need deep charting and advanced order types might find it a bit limited, but it still covers most practical needs.

Ideal user profile

If you want a secure, easy-to-use platform with both manual and automated options, this is a strong fit. Power users may prefer platforms with more customization.

Community features and active support make it friendly for social learners and new traders.

Key Strengths I Noticed While Using It

The main strengths are fast execution, mobile access, live data, and a solid demo mode. Security is a strong point with end-to-end encryption.

Automation and portfolio diversification tools let you set strategies and step away while the system works.

Feature snapshot

| Feature | Benefit |

|---|---|

| Live data & smart signals | Faster decisions |

| Mobile & fast execution | Trade anywhere |

| Demo account | Risk-free practice |

| Encryption & support | Safer funds and help |

These strengths make it practical for people who want to trade with minimal daily effort.

Limitations and Frustrations I Encountered

A few downsides: limited advanced indicators, occasional slow withdrawals, and minor lags during heavy traffic. Educational materials could be deeper.

These aren’t dealbreakers for casual traders, but serious analysts may miss higher-end tools and custom scripting.

Constructive points

Improving withdrawal speed transparency and adding more in-depth tutorials would lift the platform further.

A few more crypto pairs and advanced charting tools would please experienced users.

Is Bitcoin Sprint Trustworthy?

From my use, the platform felt secure and well-supported. Encryption and active customer support are clear positives. Some online feedback is mixed, so I recommend personal due diligence.

I always cross-check regulations and read current user reviews before funding a new platform to be safe.

How I judge trust

I looked at response times from support, encryption notices, and community feedback. The signals pointed to a legitimate service with room for greater transparency on some points.

Always start small and use the demo to confirm the workflow matches your needs.

👉 Open Your Bitcoin Sprint Account Now

What the Signup Process Looked Like for Me

Signup was simple: email verification and basic KYC steps. The free account activated quickly, and demo funds were available almost immediately.

Real-money activation required the $250 minimum deposit and a standard verification step that took a short time.

Ease and clarity

I liked the clear prompts and step-by-step guidance. A faster verification path would be helpful, but it wasn’t a major hurdle.

Support was responsive when I had a question during setup.

Minimum Deposit & Funding Process

You can start with a $250 minimum deposit, which is reasonable for many beginners. Multiple payment options are available, and the funding flow is straightforward.

Be aware to check for any fees tied to your payment method and account region.

Practical tips

I recommend testing with the demo, then funding the minimum to verify withdrawals and deposits before increasing balances. Keep receipts and confirmations handy for support if needed.

Knowing withdrawal timelines upfront avoids surprises.

Device Compatibility & Real-World Performance

The platform worked well on my phone and tablet, with good responsiveness and a clear mobile UI. Desktop access is smooth, too, and execution is fast most of the time.

Peak trading hours caused rare slowdowns, so I avoided critical trades at those times when possible.

Performance takeaways

Mobile alerts and fast execution make it practical for trading on the move. I’d advise checking network stability and avoiding large position changes during peaks.

Overall uptime felt reliable for daily trading needs.

🔥 Start Trading with Bitcoin Sprint Today

Would I Personally Recommend It?

Yes, with reservations. I’d recommend Bitcoin Sprint to beginners or casual traders who want automation, mobile access, and secure tools. It’s a strong platform for learning and practical trading.

For professional traders needing advanced analytics, I’d suggest supplementing it with a more feature-rich charting tool.

Final thought

Start with the free demo, fund the minimum to test real trades, and use the community and support when you need help. It’s a solid option that balances ease of use, security, and practical trading features.