I’ve used a lot of trading platforms, and Bitcoin Supersplit caught my eye because it blends manual and automated tools for crypto, forex, and CFDs.

I wanted to test whether it really makes trading easier for both beginners and experienced users.

Quick take

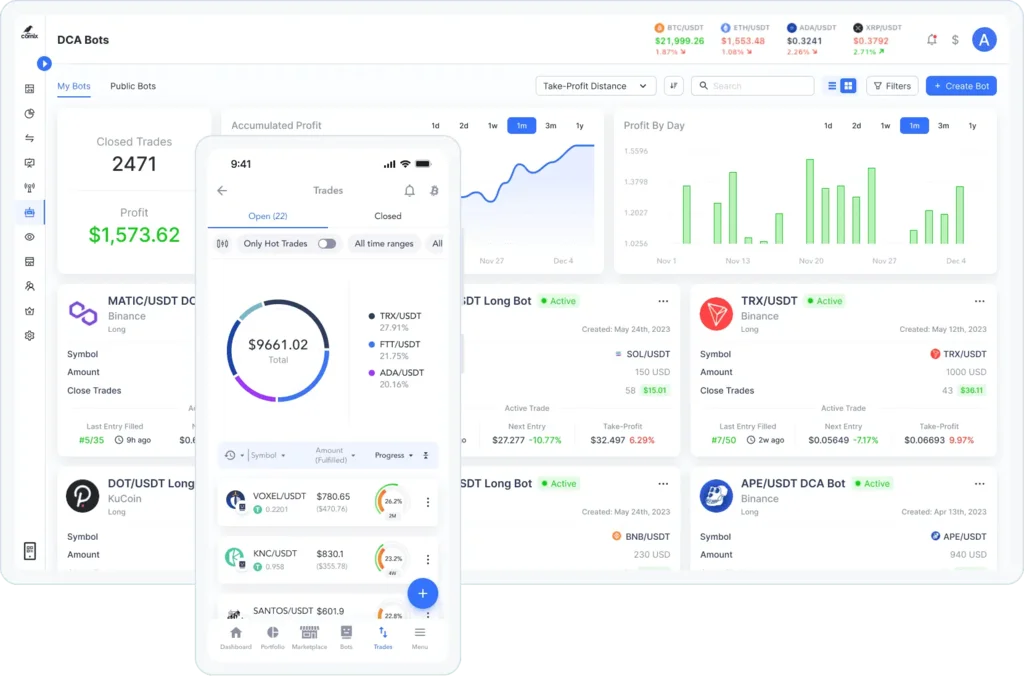

I like that the platform offers real-time analysis, customizable alerts, and a clean interface that doesn’t feel overwhelming.

My goal with this review is to share what worked well and what felt a bit off during real use.

👉 Open Your Bitcoin Supersplit Account Now

Summary

Here’s a quick fact sheet to set the scene, based on my hands-on time and the platform’s materials.

- Free signup and a demo mode to practice.

- Minimum deposit: $250 to start live trading.

- Supports crypto, forex, CFDs, and both manual and automated trading.

- Live data, smart signals, mobile access, and fast execution.

- Tools for portfolio diversification, end-to-end encryption, active support, and a trading community.

My concise verdict

Overall, it feels user-friendly and secure, with useful automation.

There are a few delays in withdrawals and support response times that are worth noting.

Why I Decided to Test Bitcoin Supersplit

I’ve seen many platforms promise automation and high returns, so I wanted to see how this one handles real trades.

I was curious if the automation is smart enough to help without demanding constant oversight.

What mattered most to me

Ease of use, reliable execution, and genuine demo/testing features were top priorities.

I also wanted to verify security claims like end-to-end encryption and data privacy.

🔥 Start Trading with Bitcoin Supersplit Today

Initial Expectations vs. Reality

I expected an intuitive interface, fast order execution, and decent algorithmic signals based on their marketing.

In reality, the interface was clean and the signals were timely, though outcomes depended on market conditions and settings.

Surprises and confirmations

The demo mode matched live behavior closely, which gave me confidence before funding a real account.

I was pleasantly surprised by mobile performance and the clarity of alerts.

First Impressions: Setup, Dashboard & Usability

Signing up was quick; the dashboard is uncluttered and makes it easy to find tools and charts.

The tutorial and default alert settings helped me get going without digging through menus.

User experience details

Customization is strong: I could set alerts, tweak automation levels, and watch live data without lag.

Some advanced options are tucked away, but that’s helpful for keeping the main screen simple for newcomers.

Who I Believe This Platform Is Best Suited For

I think it’s ideal for beginners who want an accessible entry point and for traders who like hybrid control—mixing manual and automated strategies.

Experienced traders will appreciate the fast execution and diversification tools, though they may miss extremely advanced charting.

Use-case examples

If you want to practice with a demo, then move to small live trades, this fits well.

If you need deep technical analysis every minute, you might find parts of the interface minimalistic.

Key Strengths I Noticed While Using It

The automation works well for basic strategies, and smart signals help spot opportunities without overcomplicating things.

Mobile access, fast execution, and portfolio tools make managing multiple assets straightforward.

Quick feature table

| Feature | My impression |

|---|---|

| Demo mode | Realistic and helpful |

| Automation | Solid for set-and-monitor strategies |

| Security | Strong encryption and privacy |

| Support | Active, but sometimes slow |

Limitations and Frustrations I Encountered

Withdrawals took longer than I expected on a couple of occasions, and customer support response time can lag during busy periods.

Automated trading is great, but it isn’t a guaranteed income—settings and market volatility matter a lot.

Small annoyances

Some advanced settings are hidden enough that it takes time to find them.

A few educational resources felt basic compared to deeper trading schools.

Is Bitcoin Supersplit Trustworthy?

From my use, it felt legitimate: demo behavior mirrored live, security measures are in place, and the platform runs transparently.

User reviews are mixed in parts, so it’s smart to start small and verify withdrawal processes yourself.

My safety checklist

I always recommend checking KYC steps, testing withdrawals, and using demo mode first.

Treat automation as a tool—not a guarantee—and keep risk management rules in place.

👉 Open Your Bitcoin Supersplit Account Now

What the Signup Process Looked Like for Me

Registration was straightforward: email verification and a short profile setup took only minutes.

I appreciated that demo access was immediate, letting me test before committing funds.

Verification and onboarding

KYC steps were standard and handled within the platform.

There were helpful prompts that guided me toward setting up alerts and automation.

Minimum Deposit & Funding Process

The minimum deposit of $250 is reasonable for live trading and felt fair given the tools available.

Funding options included card and bank transfer, which were convenient in my experience.

Funding notes

Deposits reflected quickly most of the time, enabling me to start trading within minutes.

Always check fees for your chosen deposit method to avoid surprises.

Device Compatibility & Real-World Performance

I used the platform on desktop and mobile; both were responsive and had the same core functions.

Live data updated fast, and trades executed without noticeable delays during my sessions.

Mobile specifics

The mobile app is compact and keeps essential controls easy to reach.

Charts are simplified on mobile but still informative for most trading needs.

🔥 Start Trading with Bitcoin Supersplit Today

Would I Personally Recommend It?

Yes—with caveats. I’d recommend Bitcoin Supersplit to newcomers and casual traders who want automation, a friendly interface, and decent security.

I’d advise cautious funding, testing via demo, and realistic expectations about returns.

Final tips from my experience

Start with the demo, set conservative automation rules, and keep regular checks on withdrawals and support responsiveness.

If you do that, the platform can be a useful part of a diversified trading routine.