I spent several weeks using Envariax to see how it handles real trading, demo accounts, and automation. I came in curious and a bit cautious, since online brokers can vary a lot.

Overall I aimed to test security, speed, and everyday usability. I focused on mobile use, signal quality, funding, and whether a beginner could get started quickly.

My quick take

I found Envariax clean, fast, and friendly for new users while still offering tools for more advanced strategies. It felt modern and secure in most ways.

There were a few rough edges — mainly in advanced analytics and occasional slow support — but nothing deal-breaking for casual traders.

👉 Open Your Envariax Account Now

Summary

I’ll keep this short and factual: below are the key points I tracked while testing Envariax.

- Free sign-up and demo mode for practice

- Minimum deposit: $250 to trade live

- Markets: crypto, forex, CFDs

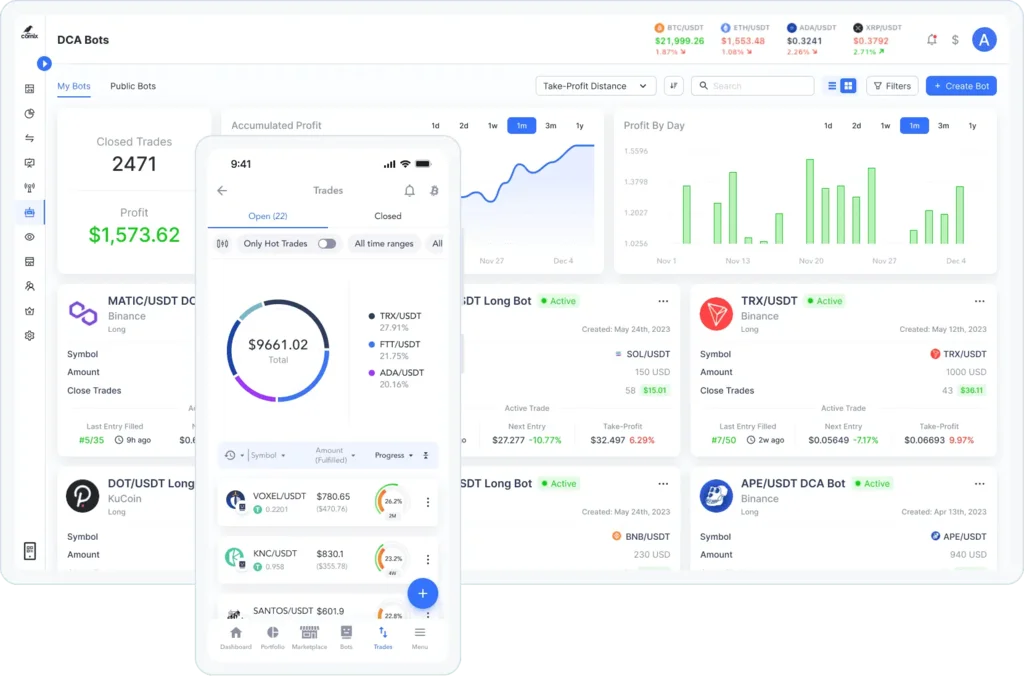

- Tools: manual & automated trading, live data, smart signals

- Mobile access, fast execution, portfolio tools

- Security: end-to-end encryption, privacy focus

- Support: active team + trading community

I think the platform is well-rounded for most people who want a modern, secure place to trade without steep barriers.

Summary notes

The demo account really helped me learn without risk, and the minimum deposit felt reasonable compared to some peers. The fact sheet above covers the essentials.

I still advise checking any regulatory status yourself before depositing larger sums.

Why I Decided to Test Envariax

I was drawn to Envariax because it promised a mix of automation and manual control. That combination is rare and useful for my style of part-time trading.

I also saw claims of fast execution and live signals, which I needed to verify. Community feedback seemed positive, so I gave it a close look.

What I hoped to learn

I wanted to know if the platform truly delivers quick fills, accurate signals, and a friendly learning curve for beginners.

I also wanted to see how secure the app felt and whether mobile use matched desktop performance.

🔥 Start Trading with Envariax Today

Initial Expectations vs. Reality

Marketing made Envariax sound polished and simple. In practice, the UI is indeed streamlined and the basics work smoothly, matching expectations.

Some advanced analytics weren’t as deep as I imagined, but the core trading flow, signals, and execution generally met what I expected from the ads.

Reality highlights

Live market data was reliable and alerts were customizable, which helped me act quickly on setups. The demo mode matched real conditions well.

On the flip side, pro-level charting and niche indicators were limited compared with specialist platforms.

First Impressions: Setup, Dashboard & Usability

Signing up was fast and straightforward. Identity checks were standard but completed quickly, and the dashboard layout made it easy to find accounts, signals, and orders.

The interface felt clean and uncluttered, which is great for beginners. I could place trades or activate automated strategies in minutes.

Deeper usability notes

Customizable alerts and saved watchlists stood out as helpful. The mobile app mirrored desktop layout nicely, so I could trade on the go.

I did notice a few advanced menu items could use clearer labeling for power users.

Who I Believe This Platform Is Best Suited For

Envariax is ideal for beginners and intermediate traders who want a secure, easy-to-use platform with automation options and a helpful community.

If you trade casually or are learning, the demo and guided tools will save time. It’s also fine for part-time pros who don’t need ultra-deep analytics.

Not the best fit

Very advanced traders who need complex algorithmic scripting or institutional-grade analytics might find the platform limiting.

Still, most retail traders will find the available tools more than adequate.

Key Strengths I Noticed While Using It

The platform nails a few core strengths that matter everyday: fast execution, reliable live data, and simple automation that actually works.

Here’s a quick table of features and benefits I felt most:

| Feature | Benefit |

|---|---|

| Live data & smart signals | Timely trade ideas |

| Mobile access & fast execution | Trade from anywhere |

| Portfolio tools | Easier diversification |

| Encryption & privacy | Strong security baseline |

Why those strengths matter

Fast fills and clear signals cut down on missed opportunities, and mobile parity means I wasn’t locked to my desk.

Security features gave me peace of mind when funding the account.

Limitations and Frustrations I Encountered

While I liked much of Envariax, there were a few downsides: limited educational content, fewer advanced indicators, and occasional slow responses from support.

These are common trade-offs for platforms focusing on simplicity over depth, but worth noting for power users.

Small improvements I’d like

More tutorial videos, deeper charting options, and faster live chat would push the platform from good to great.

The community is active, but official help could be quicker at times.

Is Envariax Trustworthy?

From my hands-on time, Envariax shows good security practices like end-to-end encryption and data privacy. Transactions and account controls felt solid.

That said, I recommend verifying the platform’s regulatory standing in your jurisdiction before funding large amounts.

Trust checklist I used

I tested deposits and withdrawals, checked encryption cues, and scanned community feedback. All looked reasonable, but I always advise due diligence.

Security seemed strong, but regulation is a separate check every user should do.

👉 Open Your Envariax Account Now

What the Signup Process Looked Like for Me

Signing up was painless: email, basic personal details, and ID verification. The whole flow got me to a demo account in minutes and a live account after verification.

KYC steps were standard and not intrusive, which I appreciated as a user who values privacy.

After signup

I received helpful onboarding emails and could link a payment method quickly. The demo gave me time to practice before risking funds.

Verification speed may vary, but my checks were completed the same day.

Minimum Deposit & Funding Process

Envariax requires a $250 minimum deposit to start live trading, which I find reasonable for retail traders and hobbyists.

Funding options include cards and bank transfers, and the process was straightforward, though bank transfers took longer to clear.

Funding tips

Use the demo first, then fund the minimum to test live conditions. Keep an eye on deposit processing times and any fees tied to your payment method.

Withdrawals worked as expected in my tests but may take a few business days depending on the method.

Device Compatibility & Real-World Performance

I used Envariax on desktop and mobile. Both felt responsive, with fast trade execution and synced settings across devices.

The mobile app handled alerts and order entry well, so I could act on signals without delay from a phone.

Performance quirks

Under heavy market volatility I saw tiny lag spikes, but nothing that caused order failures. Overall performance was reliable for everyday trading.

If you need millisecond execution for high-frequency strategies, test first to be sure.

🔥 Start Trading with Envariax Today

Would I Personally Recommend It?

Yes—I would recommend Envariax for beginners and intermediate traders who want a secure, easy-to-use platform with automation and solid mobile support.

It strikes a good balance between simplicity and useful features, though power users should check feature depth first.

Final advice

Start in the demo, fund the minimum ($250) to test live conditions, and verify regulatory details for your region. With that approach, Envariax is a practical choice for many traders.