I’ve spent years trading crypto and testing platforms, so I jumped into Fulgor Fundoria with a critical eye. I wanted a clear sense of how it handles real trading needs and security.

Overall, the platform aims to serve beginners and pros, offering manual and automated tools, plus real-time data and community support. I’ll share what I liked and what could be better.

Quick context

I tested features over several weeks to see consistency, execution, and support responsiveness. I focused on real-world use, not just marketing claims.

I kept an eye on privacy, encryption, and how the app behaved on mobile and desktop.

👉 Open Your Fulgor Fundoria Account Now

Summary

I’ll keep this short: here’s the fact sheet from my experience in bite-sized points you can skim.

- Markets: Crypto, forex, CFDs

- Access: Manual + automated tools, demo mode

- Costs: Free signup, $250 minimum deposit

- Features: Live data, smart signals, alerts, portfolio tools

- Security: End-to-end encryption, active support, community

Bottom-line summary

I found the overall offering user-friendly with strong security basics, plus a helpful demo mode and responsive support that make it easy to get started.

The platform’s strengths are clear, though there are a few minor rough edges I’ll cover below.

Why I Decided to Test Fulgor Fundoria

I read mixed reviews and wanted to verify real performance, not marketing copy. My goal was practical: trade from phone and desktop reliably.

I also wanted to evaluate the automated tools, signal quality, and how easy it is for a new trader to learn and use.

My testing approach

I used both demo and funded accounts, tried manual and automated trades, and timed execution. I also contacted support to see response quality and speed.

This gave me a rounded view of daily use, beyond the sales pitch.

🔥 Start Trading with Fulgor Fundoria Today

Initial Expectations vs. Reality

Marketing promised slick automation and high returns; I expected good UX but stayed skeptical about guaranteed profits. My tests showed realistic performance.

In reality, the interface and signals were solid for routine trades. The returns depend on strategy, not the tool; it doesn’t remove risk, but it does simplify execution.

Honest take

I appreciated the real-time data and signal clarity. Some promotional claims felt optimistic, but the platform delivered useful tools rather than magic results.

It’s a helpful tool, not a guarantee.

First Impressions: Setup, Dashboard & Usability

Signing up was quick and the dashboard felt uncluttered. I liked the clear layout for balances, open orders, and alerts.

That said, a couple of menus were nested oddly and took time to find. After a short learning curve, navigation became smooth and intuitive.

Usability highlights

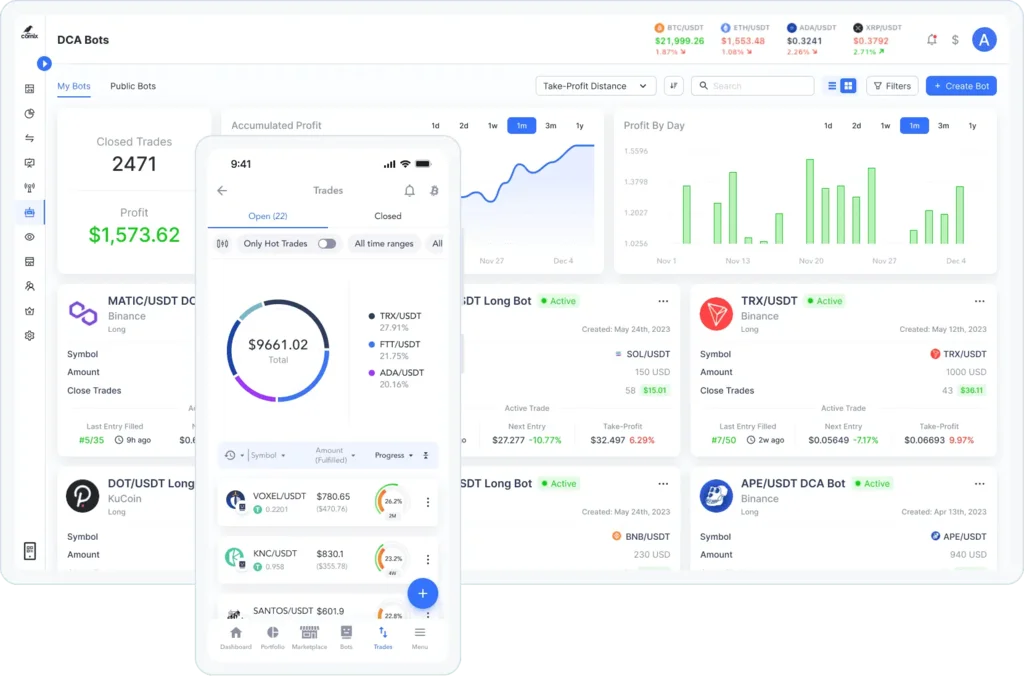

The dashboard shows live prices, performance graphs, and quick trade buttons. Custom alerts are easy to set up, which I used daily.

The demo mode mirrors the real UI, so practice carries over well.

Who I Believe This Platform Is Best Suited For

I think Fulgor Fundoria is ideal for new traders who want a guided start and intermediate users who value streamlined automation.

Experienced traders will like the fast execution but may miss very advanced charting or deep customization found on pro-only platforms.

Target user profile

- Beginners who want a friendly start

- Part-time traders needing fast mobile access

- Users who value built-in signals and community support

It’s a great bridge between simple apps and complex broker platforms.

Key Strengths I Noticed While Using It

Several strengths stood out: fast execution, clear smart signals, and solid portfolio diversification tools. Mobile access kept me trading on the go.

Customer support responded quickly in my tests, and the trading community added practical tips. Security basics like end-to-end encryption felt reassuring.

Feature snapshot (table)

| Feature | My take |

|---|---|

| Live data & signals | Accurate and timely |

| Mobile app | Responsive, fast execution |

| Security | Strong encryption, privacy focused |

These strengths make it easy to manage trades without heavy daily effort.

Limitations and Frustrations I Encountered

I did see some minor issues: occasional UI glitches, limited advanced charting, and occasional delays in fund processing. These are not deal-breakers but noticeable.

Also, some promotional statements implied easy high returns, which felt misleading. Real success still requires strategy and risk management.

Constructive notes

A few areas to improve: richer technical indicators, smoother mobile menu flow, and faster deposit clearing times for certain payment methods.

Fixing these would make the platform far stronger for experienced traders.

Is Fulgor Fundoria Trustworthy?

I looked at transparency, user feedback, and security. The platform uses end-to-end encryption and provides clear terms. Support and community are active, which is a good signal.

I did find mixed user reviews online, with mostly positive service experiences but some complaints about expectations vs. reality. Use due diligence and check regulation disclosures before large deposits.

My confidence level

I felt cautiously positive: the technical safeguards are solid and support is good, but always confirm legal/regulatory status where you live.

Trust is built over time; start small.

👉 Open Your Fulgor Fundoria Account Now

What the Signup Process Looked Like for Me

Signing up took minutes: basic info, email verification, and identity checks when funding. The demo account appeared immediately for practice trades.

I appreciated the smooth KYC flow, though some verification steps took longer during peak hours.

Practical notes

Expect to verify ID for withdrawals. Demo mode is available instantly, which I used to learn without risk.

This makes onboarding friendly and low-pressure.

Minimum Deposit & Funding Process

The minimum deposit is $250, which is competitive and reasonable for most beginners. Funding supports multiple payment methods, though processing times vary.

I experienced a short delay on one transfer, but overall funding was straightforward and the platform clearly lists accepted methods.

Deposit table

| Item | Detail |

|---|---|

| Minimum deposit | $250 |

| Funding methods | Cards, bank transfer, crypto |

| Processing time | Varies by method (usually hours to 2 days) |

Plan deposits ahead if you need funds cleared quickly.

Device Compatibility & Real-World Performance

I used both desktop and mobile apps. Desktop had fuller functionality, while mobile offered quick trades and alerts that worked reliably during market moves.

On mobile I noticed a couple of small layout limits compared with desktop, but execution speed remained fast and dependable.

Performance notes

Mobile is excellent for active alerts and quick fills. Desktop is better for detailed analysis and managing larger portfolios.

Both platforms felt secure and stable during my testing.

🔥 Start Trading with Fulgor Fundoria Today

Would I Personally Recommend It?

Yes, with caveats. I’d recommend Fulgor Fundoria for beginners and intermediate traders who want a friendly, secure platform with automation and strong support.

I’d advise experienced traders to evaluate whether they need deeper analytics. Also, always start with the demo mode and only fund what you can afford to risk.

Final advice

- Start in demo mode, then make the $250 minimum deposit when ready.

- Use built-in signals but test strategies first.

- Keep realistic expectations—tools help, they don’t remove risk.

Overall, I found it a solid, user-friendly platform that balances ease of use with meaningful security and community support.