I’ve spent years trading crypto and testing platforms, so when I found Klarvonis I dug in fast. I wanted to see if it truly helps both beginners and pros trade efficiently.

I’ll be candid: I look for security, speed, and practical tools that save time. Klarvonis promised all three, so I evaluated features, support, and real-world performance.

Quick snapshot

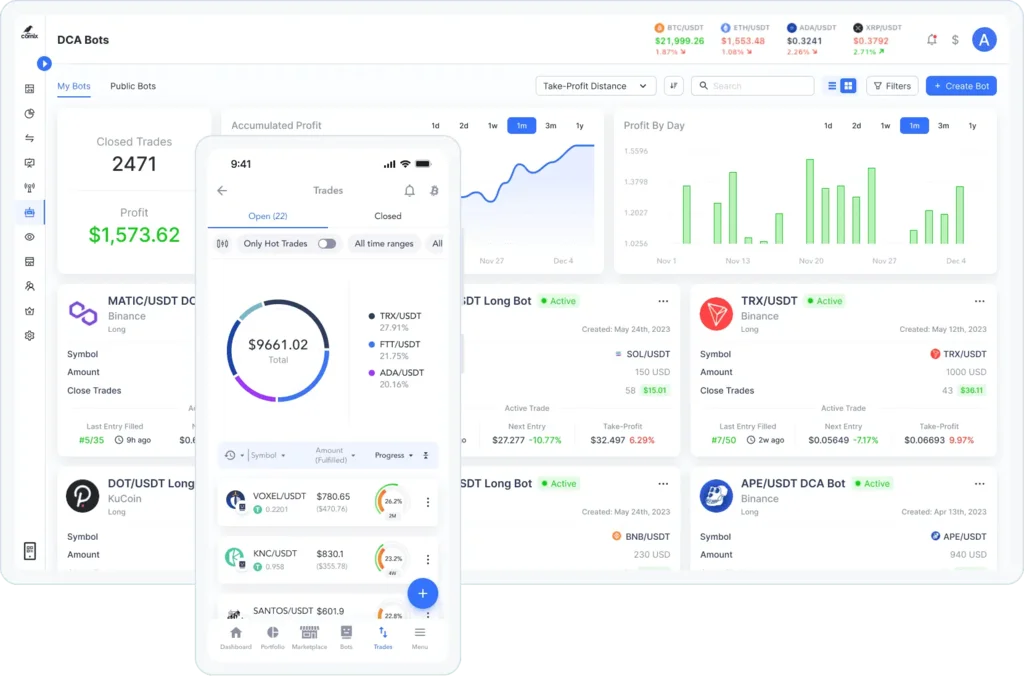

I tested account creation, demo mode, live trading, mobile app, automated strategies, and customer support. I paid attention to latency, signals, and how easy it was to manage a diversified portfolio.

I approached this with a focus on how the platform fits day-to-day trading habits and risk controls that matter to someone who trades crypto and CFDs regularly.

👉 Open Your Klarvonis Account Now

Summary

I’ll keep this tight: Klarvonis is a trading platform for crypto, forex, and CFDs that offers manual and automated tools, live data, and a demo mode. Below are the core facts I found:

- Free signup; minimum deposit $250 to start live trading

- Manual + automated trading, demo account available

- Real-time market analysis, smart signals, customizable alerts

- Mobile app, fast order execution, portfolio tools

- End-to-end encryption, data privacy, active support and community

Fact focus

These bullets are what I used to judge value: cost to start, signal quality, execution speed, security practices, and how helpful the community/support is in practical scenarios.

Those elements determined whether I felt comfortable keeping capital on the platform and trading live.

Why I Decided to Test Klarvonis

I’m always scouting platforms that combine automation with solid manual tools. Klarvonis kept popping up in chats and ads, so I wanted to separate hype from reality.

I was curious about how its smart trading signals and portfolio tools perform compared to established exchanges and brokers I already use.

Motivation

I also wanted to evaluate the newcomer experience — how fast I could sign up, test in demo, and then fund an account to trade within minutes while monitoring latency.

Practicality matters to me: if a platform slows me down during volatility, I lose opportunities.

🔥 Start Trading with Klarvonis Today

Initial Expectations vs. Reality

I expected a clean interface, reliable signals, and decent execution. In many ways Klarvonis matched that, with fast fills and clear charts.

Reality: the platform did deliver speed and usable signals, but a few advanced features felt like they needed polish. Still, the overall experience was positive and practical.

Honest contrast

I liked that the demo mode mirrored live conditions well; that raised my confidence before funding an account. On the downside, some advanced customization options were less intuitive than they should be.

For everyday trading and following signals, it was solid — for deep strategy building, it’s still catching up.

First Impressions: Setup, Dashboard & Usability

The signup and setup were straightforward. I signed up free, verified my email, and explored the demo within minutes; the UI is clean and streamlined.

The dashboard makes essentials visible: positions, alerts, and live feeds. Customizable alerts were especially handy for quick decisions.

Usability notes

I appreciated the balance between simplicity and power — beginners won’t be overwhelmed, and experienced users can still access automation and data.

A minor gripe: a few advanced menus aren’t labelled clearly, so it took a moment to find deeper settings.

Who I Believe This Platform Is Best Suited For

I’d recommend Klarvonis to beginners who want guided tools and to intermediate traders who value automation and fast execution. The demo mode lowers the barrier to learn.

Active traders who swing between crypto and forex/CFDs will like the cross-asset view and portfolio diversification tools.

Not ideal for everyone

If you are a full-time quant or need hyper-custom algorithmic scripting, Klarvonis may feel limiting today. It’s geared more toward practical automation than deep custom coding.

For most retail traders seeking efficiency and decent automation, it’s a great fit.

Key Strengths I Noticed While Using It

The platform’s main strengths are speed, mobile accessibility, real-time data, and smart trading signals. Execution felt reliable during my tests.

Security features like end-to-end encryption and active customer support plus a trading community added trust and helped when I had questions.

Quick pros table

| Strength | Why it matters |

|---|---|

| Fast execution | Limits slippage in volatile markets |

| Live data & signals | Helps spot opportunities quickly |

| Mobile app | Trade and monitor from anywhere |

| Security & support | Protects funds and answers issues |

These strengths make Klarvonis practical for everyday traders who want to stay active without micromanaging every trade.

Limitations and Frustrations I Encountered

No platform is perfect. I saw some inconsistent loading times on heavier dashboards and a few advanced features that felt underdeveloped.

Documentation could be clearer for power features, and fee transparency deserved a bit more upfront clarity in places.

Constructive criticism

Customer support was responsive, but I’d like faster resolution for complex issues and more in-app tutorials for advanced tools.

These are fixable growing pains rather than dealbreakers for most users.

Is Klarvonis Trustworthy?

From my hands-on use, Klarvonis appears legitimate and security-conscious. Encryption, community oversight, and responsive support all point to a platform that cares about users.

I always recommend keeping capital controls and using the demo first; treat any platform cautiously until you’re comfortable.

Confidence level

I’d rate my trust as high for retail use, provided you follow standard safety steps: enable 2FA, test in demo, and start small with the $250 minimum until you’re confident.

Trust grows with transparency and time; Klarvonis is on the right track.

👉 Open Your Klarvonis Account Now

What the Signup Process Looked Like for Me

Signing up was quick: name, email, password, and email verification. The process took less than five minutes to reach the demo environment.

I found the onboarding helpful and not cluttered with upsells. The demo felt realistic, which let me test strategies risk-free.

Onboarding detail

After verification I could link payment methods and read FAQs. The interface nudged me toward learning resources and community chat, which I appreciated.

Smooth onboarding makes a big difference when learning a new trading workflow.

Minimum Deposit & Funding Process

Klarvonis allows free signup but requires a minimum deposit of $250 to open live trading. Funding was straightforward with standard payment options supported.

Deposits cleared fast enough in my case, and the platform shows available balance and funding history clearly.

Funding tips

Start with the demo, then move to the minimum deposit to test live execution. Keep an eye on withdrawal times and verify identity early to avoid delays.

Treat the deposit as your trial capital until you’re satisfied with execution and fees.

Device Compatibility & Real-World Performance

I used Klarvonis on desktop and mobile. The mobile app is responsive and I saw no meaningful delays for normal trading; charts and alerts synced well.

During high-volatility tests execution was fast, though complex dashboards sometimes took an extra second to load on older tablets.

Performance takeaways

For daily traders the platform is reliable. I’d still recommend a wired connection or strong Wi‑Fi when executing time-sensitive orders to minimize any network-related lag.

Overall, performance matched my needs for crypto and CFD trading.

🔥 Start Trading with Klarvonis Today

Would I Personally Recommend It?

Yes — I’d recommend Klarvonis to traders who want a balanced mix of automation, live signals, and fast execution with strong security. It’s a solid place to learn and trade.

Start in the demo, fund the minimum $250 when ready, and scale up as you test strategies. Expect a few rough edges, but nothing game‑breaking.

Final thought

I like Klarvonis for its practical tools and community support. It’s not perfect for deep quant work yet, but for most traders it’s a trustworthy, efficient platform worth trying.