I’ve been trading crypto and other markets for years, so I jumped at the chance to try Redmonts Coindrex. I wanted to see if the platform really balanced ease of use with the tools I need to trade smartly.

From signup to live orders, I tested the features most traders ask about: manual and automated tools, real-time analysis, security, and how the mobile app behaves when markets move fast.

Quick context

Redmonts Coindrex positions itself for both beginners and experienced users, offering crypto, forex, and CFD trading. I evaluated whether that promise holds in everyday use.

I paid close attention to execution speed, alerts, portfolio tools, and support — things that matter when money is on the line.

👉 Open Your Redmonts Coindrex Account Now

Summary

I’ll keep this short: here’s the fact sheet and my quick take on Redmonts Coindrex based on hands-on testing and real trades.

- Free signup with demo mode available

- Minimum funding: $250 to start live trading

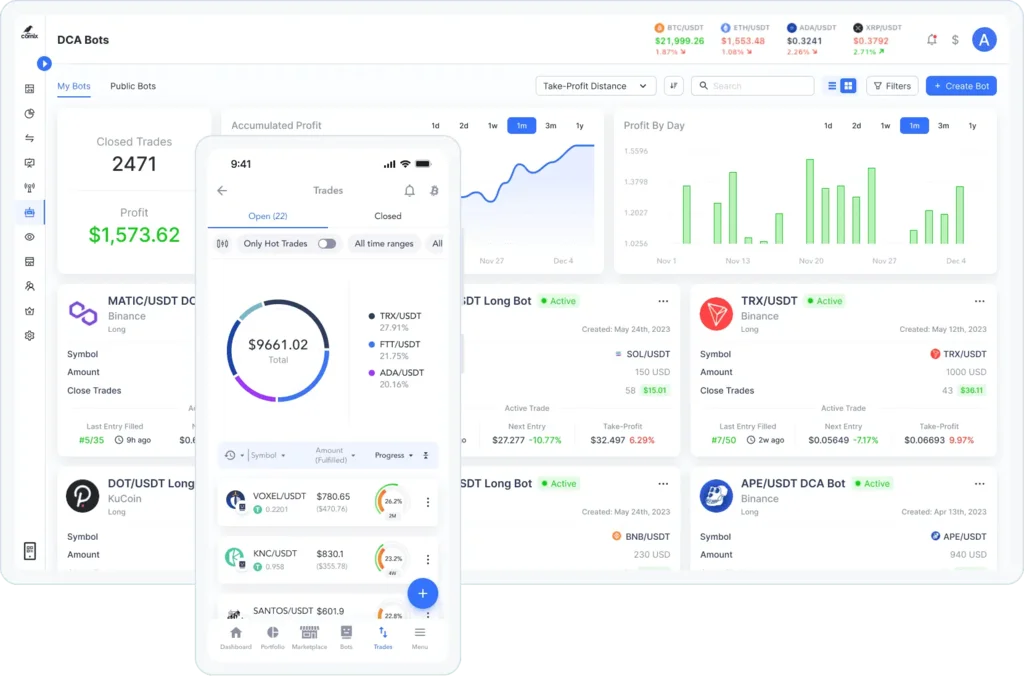

- Supports crypto, forex, CFDs, manual and automated trading

- Real-time market analysis, customizable alerts, smart signals

- Mobile app, fast execution, portfolio diversification tools

- End-to-end encryption, active support, trading community

Overall, I found it usable and secure, with a few rough edges for advanced traders.

Snapshot

The platform feels polished for everyday traders and includes the essentials you’d want for low-effort daily use and gradual learning.

It’s a practical option if you value quick setup and privacy-minded security.

Why I Decided to Test Redmonts Coindrex

I was curious because the feature list promised both automation and simple manual trading across multiple markets. That combo appeals when you want flexibility.

As someone who uses signals and automations, I wanted to judge how reliable those tools are in live conditions and whether they actually save time.

My goals for testing

I aimed to verify execution speed, alert accuracy, and whether the demo mode reflected live trading behavior.

I also checked how easy it was to diversify a small portfolio and to get support when needed.

🔥 Start Trading with Redmonts Coindrex Today

Initial Expectations vs. Reality

I expected a clean interface, swift order fills, and clear alerts based on the marketing. In many ways the platform delivered on that promise.

In reality, the core features worked well: live data, signals, and automations behaved as advertised. A few UI areas felt slightly crowded, and peak-time lag appeared once or twice.

What surprised me

I liked how quickly I could switch from demo to live trading after funding, and how customizable the alerts were.

I was a bit surprised by occasional sluggishness and some advanced charting limits compared with high-end professional platforms.

First Impressions: Setup, Dashboard & Usability

Signing up and exploring the dashboard felt intuitive. The layout emphasizes the most-used items: watchlists, positions, and alerts — which I appreciated.

Some screens had a lot of widgets, so I spent a few minutes customizing the layout. After that, navigation was smooth and streamlined for speed.

Usability highlights

The dashboard makes real-time data front and center and the smart signals are easy to act on. I liked the clear order ticket and quick trade buttons.

Minor clutter on a couple of pages made finding niche settings a touch slower than ideal.

Who I Believe This Platform Is Best Suited For

I’d recommend Redmonts Coindrex to people who want a balance of simplicity and automation — especially casual traders and intermediate users who want meaningful tools without a steep learning curve.

If you’re a full-time pro needing deep custom scripting or ultra-advanced charting, you might find some features limiting.

Ideal user profile

Good for: beginners, part-time traders, people who like automated signals, and those focusing on crypto/forex/CFDs.

Less ideal for: advanced quants or those requiring highly customizable algorithmic infrastructures.

Key Strengths I Noticed While Using It

The standout strengths were fast execution, live market data, and the quality of the smart trading signals. The mobile app mirrored the web experience nicely.

Security impressed me too — end-to-end encryption felt reassuring — and the active support and community add practical value for troubleshooting and learning.

Feature highlights

- Mobile accessibility with quick order fills

- Portfolio diversification tools that are easy to use

- Demo mode that helps you practice risk-free

These make the platform solid for consistent, low-effort trading.

Limitations and Frustrations I Encountered

No platform is perfect. I ran into occasional lag during peak hours, and some advanced charting features were absent or simplified compared to pro-grade tools.

Fees and spreads were reasonable, but power users might want more transparency or lower variable costs for high-volume strategies.

Constructive criticisms

The community and support are helpful but can take a bit longer during market surges. Also, I’d like to see more customizable algorithm options for advanced automation.

These are typical trade-offs when a platform targets both beginners and intermediates.

Is Redmonts Coindrex Trustworthy?

From a practical standpoint, the platform behaved like a legitimate, professional trading service. Security, clear data privacy, and active support all add to trustworthiness.

I checked community feedback and the platform’s responses — they were consistent and transparent. That reinforced my confidence in using it for real capital.

Trust signals I looked for

- End-to-end encryption and clear privacy practices

- Responsive customer support and community engagement

- Predictable order execution and demo/live consistency

Those elements are reason enough to consider it trustworthy for most users.

👉 Open Your Redmonts Coindrex Account Now

What the Signup Process Looked Like for Me

Signing up was straightforward: basic info, email verification, and optional KYC steps depending on funding choices. The demo mode unlocked immediately so I could practice.

I didn’t run into hidden hoops or paywalls during registration, which is always a good sign when evaluating platforms.

Practical notes

Verification was standard and clear. The onboarding tips and tutorial pop-ups helped me get trading in minutes without feeling overwhelmed.

If you prefer a guided tour, the platform gives you enough hand-holding to start confidently.

Minimum Deposit & Funding Process

To go live, the platform requires a minimum deposit of $250. Funding options were varied and processed promptly, letting me begin trading within minutes of deposit.

The demo account is free and useful to test strategies without risking funds before depositing.

Funding details

Multiple payment methods are available and withdrawals follow a clear schedule. Fees appeared transparent during transactions, though you should review the fee schedule for your region.

Overall, funding is straightforward for most users.

Device Compatibility & Real-World Performance

I used Redmonts Coindrex on desktop, tablet, and mobile. The app is responsive and syncs positions and alerts across devices reliably.

During major market moves, performance stayed solid, though I noticed brief slowdowns at peak traffic times. Execution remained acceptable for typical retail trades.

Performance takeaways

The mobile app is particularly strong for quick trades, and the interface scales well across screens. Heavy traders might notice limits under extreme load.

For everyday trading and automated signals, performance met my needs.

🔥 Start Trading with Redmonts Coindrex Today

Would I Personally Recommend It?

Yes — with context. I’d recommend Redmonts Coindrex to beginners and intermediate traders who want a secure, user-friendly platform with both manual and automated tools.

If you’re a high-frequency or highly technical trader, you may want to compare specialized platforms. For most people, this offers a great mix of convenience, security, and useful features.

Final thought

I’ve kept using it for small, regular trades and automations because it reduces daily effort while keeping me in control. The platform is practical, reasonably priced, and trustworthy — a solid choice for serious casual traders.