I tested Tezos Code because I wanted a clear view of an automated trading platform for crypto, forex and CFDs. I approached it as someone who uses trading tools regularly and values simplicity.

The platform claims manual and automated tools, real-time analysis, and a streamlined interface. I focused on how practical those claims felt in daily use and whether they match real-world trading needs.

Quick note

I also checked security and community features since those matter a lot to me when I trust a platform with funds.

👉 Open Your Tezos Code Account Now

Summary

I’ll keep this concise and factual so you can skim quickly and decide what to read next. Below are the main features I found while testing.

- Free signup and demo mode available

- Minimum deposit: $250 to begin live trading

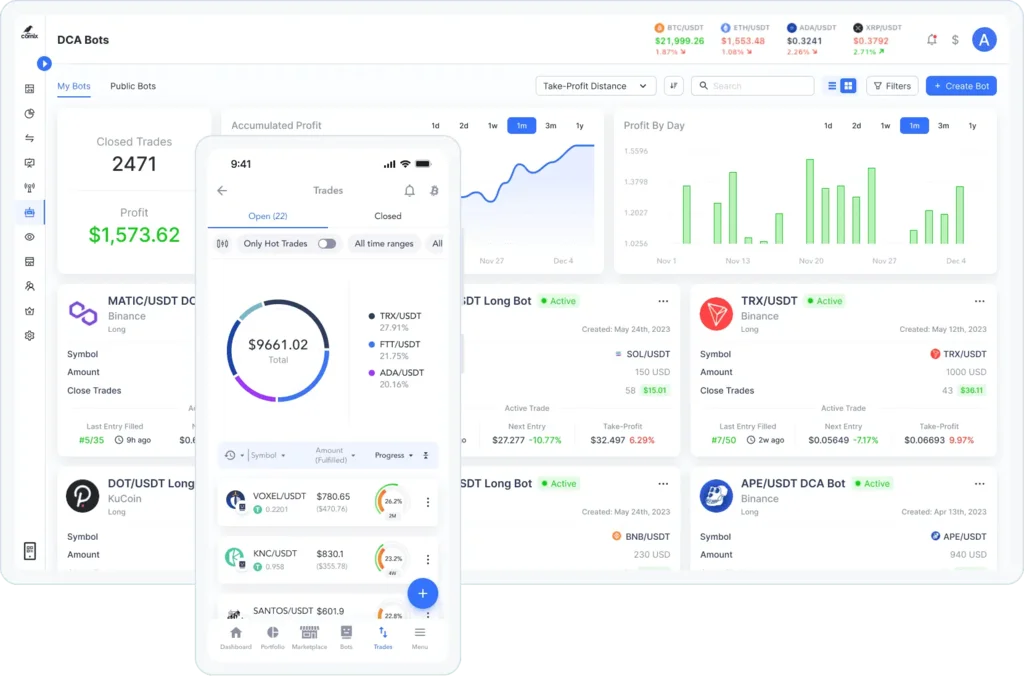

- Supports crypto, forex, CFDs with manual & automated tools

- Real-time market analysis, customizable alerts, smart signals

- Mobile access, fast execution, portfolio diversification tools

- End-to-end encryption, active support, trading community

Quick takeaway

Overall, the platform emphasizes usability and security, with features that suit both casual and active traders.

Why I Decided to Test Tezos Code

I wanted to see if the platform’s automation actually helps reduce daily effort while keeping control. As a user, I often test tools that promise passive gains without heavy oversight.

My aim was practical: confirm whether live data and signals are reliable, whether the demo mirrors live trading, and if the onboarding is beginner-friendly.

Motivation

I also wanted to evaluate customer support and community activity, which influence how quickly issues get resolved.

🔥 Start Trading with Tezos Code Today

Initial Expectations vs. Reality

I expected a smooth, beginner-friendly dashboard and solid automated strategies. The reality was mostly positive, but not flawless.

The interface is streamlined and the signals are timely, yet I saw occasional glitches and a few missing learning resources for total beginners.

Reality check

So, expectations were met on speed and core features, but real-world polish and onboarding could be better.

First Impressions: Setup, Dashboard & Usability

Signing up was straightforward and the dashboard felt modern. Customizable alerts and clean charts made it easy to scan opportunities.

Navigation sometimes hid advanced settings and the mobile app lacked a couple of desktop features, but overall usability is strong and uncluttered.

User experience

I liked how quickly I could move from demo to live; the visual layout helps both new and experienced users focus on key metrics.

Who I Believe This Platform Is Best Suited For

I’d recommend it to traders who have some basic market knowledge and want automation to supplement their strategies. It fits both part-timers and active users.

Complete beginners can use the demo mode, but they should pair it with external learning before risking real capital.

Ideal user

Experienced traders will appreciate fast execution and custom alerts, while intermediate users benefit from portfolio tools.

Key Strengths I Noticed While Using It

The platform excels at real-time data, responsive smart trading signals, and fast execution on mobile and desktop. Portfolio diversification tools are useful for risk balance.

Security stands out with end-to-end encryption, and the active support plus community make troubleshooting quicker and social learning possible.

Highlights

I also liked the seamless funding options and the way automated and manual modes coexist without feeling clunky.

Limitations and Frustrations I Encountered

There were a few annoyances: the mobile app misses some desktop features, verification times vary, and educational content is limited for newcomers.

I also saw occasional technical hiccups during high volume moments. The $250 minimum may be steep for small hobby traders.

Balanced critique

These issues aren’t deal-breakers, but they’re worth noting before committing larger sums.

Is Tezos Code Trustworthy?

From my tests, the platform appears secure and professional. Encryption and data privacy are in place, and support responds actively when needed.

That said, I always suggest using the demo, starting small, and reading community feedback before fully trusting any trading platform.

Trust tip

Treat it like a tool—not a guarantee—and manage risk accordingly.

👉 Open Your Tezos Code Account Now

What the Signup Process Looked Like for Me

Signing up was quick and I was able to set up a demo immediately. Identity verification completed within a short time for me, though some users report longer waits.

The onboarding walks you through basics, but I wished there were more interactive tutorials for first-timers.

Signup summary

Overall, it’s fast to get started, especially if you want to try the demo before depositing.

Minimum Deposit & Funding Process

Minimum deposit to trade live is $250. Funding was smooth with options like credit card and bank transfer. Withdrawals followed expected timelines in my experience.

| Item | Details |

|---|---|

| Minimum deposit | $250 |

| Demo mode | Available |

| Payment options | Card, bank transfer (varies by region) |

Funding note

I recommend testing deposits and small withdrawals first to confirm payment speed for your account.

Device Compatibility & Real-World Performance

I used both desktop and mobile. Performance felt reliable with quick order execution and live updates. Mobile is great for on-the-go trades but misses a few advanced tools found on desktop.

Connection stability was solid, though heavy market volatility showed a couple of minor lag moments.

Performance verdict

For daily use the platform is responsive; high-frequency traders should monitor execution during peak times.

🔥 Start Trading with Tezos Code Today

Would I Personally Recommend It?

Yes—with caveats. I’d recommend it to traders who know the basics and want a mix of automation and control. Use the demo, start small, and take advantage of the community for tips.

For complete beginners, pair this platform with educational resources and expect a learning curve before risking real funds.

Final advice

Start with the demo, fund the account conservatively (remember the $250 minimum), and treat signals as helpful input—not a guaranteed profit path.